The banking world is evolving rapidly, shifting from generic, one-size-fits-all services to personalized experiences tailored to each customer. With the help of modern technologies like AI, big data, and automation, banks are delivering services that feel more human and intuitive—building stronger connections with their customers.

In this blog, we’ll explore how banks transform with personalization technologies, the benefits of these innovations, and how banks can implement personalized experiences effectively.

What Is Personalization in Banking?

Personalization in banking is about delivering services and products that match individual customers’ needs, preferences, and goals. Instead of bombarding customers with irrelevant offers, banks now focus on understanding their unique journeys to provide meaningful solutions.

For example:

- Recommending savings plans for customers who aim to buy a home.

- Offering travel credit cards to frequent flyers.

- Alerting customers about duplicate subscriptions to help them save money.

This approach ensures customers feel valued and supported, making banking more enjoyable and efficient.

Why Does Personalization Matter?

Personalization is no longer a luxury—it’s a necessity for banks to stay competitive. Here’s why:

- Enhanced Customer Experience: Tailored services make customers feel understood and cared for.

- Increased Loyalty: When banks meet customers’ needs, they’re less likely to switch to competitors.

- Boosted Revenue: Personalized offers, like loans or investment services, drive more product usage.

The Technologies Driving Banking Personalization

To deliver seamless personalization, banks leverage cutting-edge technologies. Let’s break down some of the most impactful ones.

1. Artificial Intelligence (AI)

One of the most impactful innovations in this space is Artificial Intelligence (AI), which forms the backbone of many personalized banking experiences.

What is Artificial Intelligence (AI), and How Does it Work in Banking Personalization?

Artificial Intelligence, or AI, refers to the ability of machines to mimic human intelligence. Through advanced algorithms, AI processes vast amounts of data, identifies patterns, and makes predictions or decisions. In the context of banking, AI plays a transformative role in personalizing services, offering customers tailored solutions based on their unique preferences, behaviors, and financial needs.

Here’s how AI works in banking personalization:

- Data Analysis at Scale

AI analyzes extensive customer data, including transaction history, spending habits, and demographic information. This allows banks to gain deep insights into their customers’ needs and preferences. - Personalized Recommendations

By uncovering trends and patterns, AI can predict a customer’s future financial requirements. For instance, if someone is frequently making travel-related purchases, the bank might recommend a travel-friendly credit card or travel insurance. Similarly, AI can identify customers approaching retirement and suggest tailored investment plans. - Generative AI for Smarter Interactions

Generative AI, a subset of AI, is revolutionizing customer engagement in banking. It can create personalized, human-like responses in real-time, making interactions smoother and more intuitive. According to a survey by Google Cloud, 92% of banking executives believe generative AI will transform the industry. For customers, this means faster, smarter, and more meaningful interactions—whether it’s resolving queries, accessing financial advice, or receiving product recommendations. - Predictive Analytics

AI leverages predictive analytics to anticipate customer needs. For example, it can flag accounts where overdraft protection might be beneficial or suggest a savings plan based on spending trends. - Fraud Detection and Risk Mitigation

AI doesn’t just improve personalization—it also enhances security. By analyzing real-time transactional data, it detects unusual patterns that may indicate fraudulent activity, protecting customers while maintaining a seamless banking experience.

With AI, banks can create meaningful connections with their customers by delivering timely and relevant services. It’s not just about efficiency but also about making every customer feel understood and valued. As this technology evolves, the scope of banking personalization will only grow, setting new benchmarks for customer satisfaction.

2. Big Data

What is Big Data, and How Does it Work in Banking Personalization?

Big Data refers to the immense volume of structured and unstructured data generated daily by individuals and organizations. For banks, big data is a goldmine, offering valuable insights into customer behaviors, preferences, and needs. When analyzed effectively, big data helps financial institutions deliver hyper-personalized services that enhance customer experiences and foster loyalty.

Here’s how big data works in banking personalization:

- Combining Data Sources

Big data in banking integrates internal data (like transaction history, account activity, and demographic details) with external data (such as market trends, economic indicators, and even social media sentiment). This comprehensive view allows banks to gain a deeper understanding of their customers. - Customer Segmentation and Profiling

By analyzing data, banks can segment customers into different groups based on behavior, preferences, and financial goals. For example, a young professional saving for a house might receive tailored advice on mortgage options, while a frequent traveler might be offered travel insurance or reward programs. - Real-Time Insights and Personalization

Big data enables real-time insights that power personalized banking services. For instance, if a customer spends heavily during a specific season, the bank could offer seasonal discounts or cashback deals. Alternatively, banks can identify customers with high savings potential and recommend high-yield investment opportunities. - Practical Use Cases in Banking

- Santander’s Gravity Platform: This cloud-native core banking system leverages big data to simplify banking processes, improving efficiency and enhancing customer interactions.

- Citibank’s Analytics Tools: Citibank employs big data analytics to offer real-time services. For instance, their system analyzes customer behavior and instantly recommends relevant financial products, streamlining decision-making for customers.

- Predictive Analytics for Future Needs

Big data doesn’t just analyze past behavior—it predicts future actions. For instance, it can identify patterns signaling an upcoming financial need, such as home loans or retirement planning, allowing banks to proactively offer solutions.

By utilizing big data, banks create a more personalized, responsive, and meaningful customer experience. This technology bridges the gap between generic banking services and tailored solutions, ensuring that each customer feels understood and valued. As big data capabilities expand, the possibilities for deeper personalization in banking are virtually limitless.

3. Automated Services

Automation is revolutionizing the banking sector by taking over repetitive, time-consuming tasks such as customer onboarding, data entry, and compliance checks. This transformation frees employees to focus on strategic tasks that require human expertise, ultimately boosting efficiency and improving customer satisfaction.

How Automation Works in Banking

Robotic Process Automation (RPA) is at the forefront of this change. By mimicking human actions, RPA algorithms perform tasks faster and with fewer errors. For more complex workflows, Intelligent Automation (IA)—a combination of RPA, AI, and cognitive technologies—takes automation to the next level. It processes payments, detects fraudulent activities, manages compliance, and even generates detailed reports.

Benefits of Automation

- Efficiency Gains: Automation speeds up processes, significantly reducing time-to-revenue. For example, automated onboarding can cut the time required by up to 20%.

- Cost Savings: By automating repetitive tasks, banks can lower operational costs by as much as 30%.

- Customer Convenience: Intelligent automation enables customers to complete tasks like document validation and loan approvals online, anytime, without visiting a branch.

Real-World Example

JPMorgan Chase has embraced intelligent automation to optimize operations, from fraud detection to compliance management. Their innovative approach earned them the “Excellence in Intelligent Automation” award, showcasing the potential of these technologies to transform banking workflows.

In the near future, automation is set to play an even larger role, with the global banking automation market projected to grow from $4.41 billion in 2023 to $13.39 billion by 2030. The era of automated banking services is here, promising faster, smarter, and more customer-focused operations.

4. Chatbots (Virtual Assistants)

Chatbots, also known as virtual assistants, are reshaping the way banks interact with their customers. These AI-powered tools offer round-the-clock customer support, helping users with queries, recommending products, and even guiding them through financial tasks.

How Chatbots Work in Banking

Chatbots use natural language processing (NLP) and machine learning (ML) to understand customer queries and provide appropriate responses. Over time, they learn from past interactions to improve their accuracy and tailor recommendations. For example, a chatbot might suggest a travel-friendly credit card to a customer who frequently books flights.

Benefits of Chatbots

- 24/7 Availability: Unlike human staff, chatbots are always available, offering instant support at any time.

- Personalized Assistance: By analyzing user data, chatbots provide tailored suggestions, making banking more convenient and efficient.

- Cost Efficiency: Chatbots handle a large volume of queries, reducing the need for extensive customer service teams.

Real-World Example

In 2022, around 37% of U.S. consumers engaged with banking chatbots, reflecting their growing popularity. Banks use these virtual assistants across mobile apps, websites, and social media to answer common questions, assist with transactions, and guide customers in real-time.

Challenges and the Future

While chatbots are a valuable tool, they still face challenges in handling complex issues. Customers may occasionally feel dissatisfied if the chatbot cannot provide adequate answers. However, as technology advances, these limitations are diminishing. By 2030, the chatbot market for banking and financial services is expected to grow to $6.83 billion, up from $586 million in 2019, highlighting their expanding role in delivering personalized banking experiences.

Chatbots represent the future of customer service in banking, offering a blend of convenience, personalization, and accessibility.

5. Personalized Cybersecurity

In the digital age, customer security is non-negotiable, and banks are investing heavily in personalized cybersecurity to safeguard sensitive information. These measures not only protect against fraud but also build customer trust and loyalty.

What is Personalized Cybersecurity?

Personalized cybersecurity refers to tailored security measures designed to protect individual customers based on their behaviors and preferences. Common methods include:

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring a second verification step, like a code sent to your phone.

- Biometrics: Utilizes unique identifiers such as fingerprints, facial recognition, or voice patterns for secure access.

How Machine Learning Enhances Security

Machine learning (ML) plays a critical role in fraud detection and prevention. By analyzing real-time transactional data, ML algorithms detect unusual patterns, such as:

- Sudden spikes in transaction volume.

- Transfers to unfamiliar accounts.

- Transactions from geographically distant locations.

When anomalies are identified, banks can act swiftly to block suspicious activity, minimizing potential damage.

Real-World Impact

In 2022, 70% of financial institutions reported over $500,000 in fraud-related losses. Machine learning and automation emerged as critical tools in addressing these challenges, with 46% of organizations adopting automated solutions to tackle fraud.

Additionally, investments in cybersecurity have proven highly effective. Financial institutions report a return on investment of over 40% and significant reductions in data breach costs.

Why It Matters to Customers

According to Forrester, 45% of customers are willing to share their data if it results in personalized offers, but they expect transparency and control over how their information is used. By implementing robust cybersecurity measures, banks show customers they prioritize data privacy and protection, strengthening relationships and trust.

Personalized cybersecurity isn’t just about preventing fraud; it’s about creating a secure, trustworthy environment where customers feel confident managing their finances.

How Banks Are Using Personalization in Action

Here are some real-life examples of how banks are making personalization work:

- Real-Time Offers: Banks send timely loan or credit card offers based on customers’ current needs.

- Customized Pricing: High-credit-score customers may get lower interest rates on loans.

- Personalized Financial Advice: AI-driven tools suggest budgets, savings plans, or investment strategies tailored to individual goals.

How Banks Can Implement Personalization

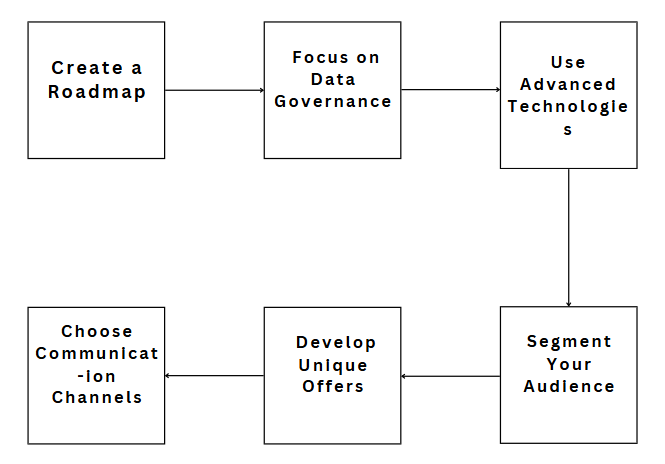

For banks looking to embrace personalization, here are six clear steps to get started:

1. Create a Roadmap

Start by defining your goals. Do you want to improve customer retention, increase product usage, or offer more relevant services? A clear plan ensures you’re moving in the right direction.

2. Focus on Data Governance

Understand what data you already have, clean up unnecessary data, and identify what’s missing. Use modern tools like customer data platforms or enterprise resource management systems to unify and secure your data.

3. Use Advanced Technologies

Introduce AI and machine learning to analyze customer behaviors and make accurate predictions. These tools speed up data processing and allow banks to make informed decisions quickly.

4. Segment Your Audience

Group customers based on their preferences, behaviors, and needs. For instance, a young professional saving for a car and a retiree planning their investments would require different approaches.

5. Develop Unique Offers

Create tailored solutions for each segment. For example:

- Travel Credit Cards: For customers who frequently book flights.

- Reduced Loan Interest Rates: For high-credit-score customers.

- Loyalty Rewards: Offering higher savings account interest for long-term clients.

6. Choose Communication Channels

Decide how to connect with your audience. Weekly emails, personalized mobile app notifications, or even social media can keep customers engaged. Don’t overlook in-person interactions at bank branches, as customers still value face-to-face advice for complex matters.

The Benefits of Personalization

For Customers:

- More Control: Tailored advice helps customers make informed financial decisions.

- Convenience: Services and solutions feel effortless and relevant.

- Stronger Trust: Transparent processes and personalized security measures build confidence.

For Banks:

- Higher Engagement: Personalized services lead to more usage of banking products.

- Improved Efficiency: Automation and AI reduce manual tasks and errors.

- Competitive Edge: Personalization sets banks apart in a crowded market.

The Future of Banking Personalization

Personalization is not just a trend—it’s the future of banking. Here’s what lies ahead:

- Hyper-Personalization: AI will refine services down to individual preferences.

- Real-Time Fraud Detection: ML will provide instant alerts for suspicious activity.

- Seamless Automation: Every interaction—whether through chatbots, apps, or in-branch—will be optimized for the customer’s unique needs.

Conclusion: A Win-Win for Banks and Customers

Banking personalization is revolutionizing how customers experience financial services. From AI-driven insights to chatbots and tailored pricing, the possibilities are endless. For customers, it means convenience, trust, and financial empowerment. For banks, it’s a pathway to growth, loyalty, and innovation.

The journey to personalized banking is ongoing—but the benefits are worth it. By focusing on data, advanced technologies, and customer needs, banks can build relationships that truly last. Let’s make banking smarter, simpler, and more human. Ready to join the revolution?